The future of financial banks promises a remarkable transformation. Their products and services will be seamlessly integrated into consumers’ daily lives. We expect to see a world where payments and financial transactions will flow without effort, and integration into non-bank apps will be easier.

The future of fully integrated banking experiences

It is well-known how artificial intelligence and advanced data analytics have empowered and will empower banks. With these technologies, understanding each customer individually and predicting their needs in real-time will become faster and easier.

Financial activities like making payments, applying for loans, or transferring money within apps and platforms are becoming more accessible and straightforward.

The future is where human expertise will remain essential for navigating major financial decisions like mortgage advice, small business loans, inheritance planning, and retirement.

So here becomes the most significant challenge: fuse AI Insight with human empathy. Banks must be prepared for this cultural shift before anticipating a technological revolution that enhances the customer experience, and this shift is all about creating an environment that promotes collaboration, adaptability, and a collective dedication to innovation, permeating all levels of the organization.

Technologies that will set banks apart

Understanding customer needs through data is essential to anticipate and solve customer requirements, and with advanced analytics and other technologies, this is possible.

Let’s get to know more about these technology trends:

– Data and AI: Efficiently harnessing all the data banks collect is a challenge, but with the entry of AI and machine learning, understanding transaction histories, customer demographics, and market trends becomes easier, helping banks to hyper-personalize offerings and predict customer needs.

– Open API architectures: When talking about seamless integration with fintech partners, we discuss open API architectures. This represents another fundamental technological advancement. Through APIs, banks empower partners to self-serve and leverage the banks’ strengths, enhancing customer experiences.

– Cybersecurity: Cybercriminals are constantly improving their tactics, targeting mobile devices more sophisticatedly than ever, especially regarding malware development. Thus, financial institutions and their dev teams must improve protection and resort to best practices, such as Implementing advanced code protection techniques, enabling runtime visibility across threat vectors, and deploying on-device protection.

One by one the tools and trends for this 2024

As we saw earlier, it is important to understand the new technology trends in order to make the best decision on which software development tool to choose. First, let’s look briefly at what a software development tool is.

Basically, it is a program or application that aims to assist developers during the software development lifecycle (SDLC), helping them in processes like creating, modifying, testing, and maintaining the resulting software product, program, application, or system.

Here is a list of the best software development tools to use:

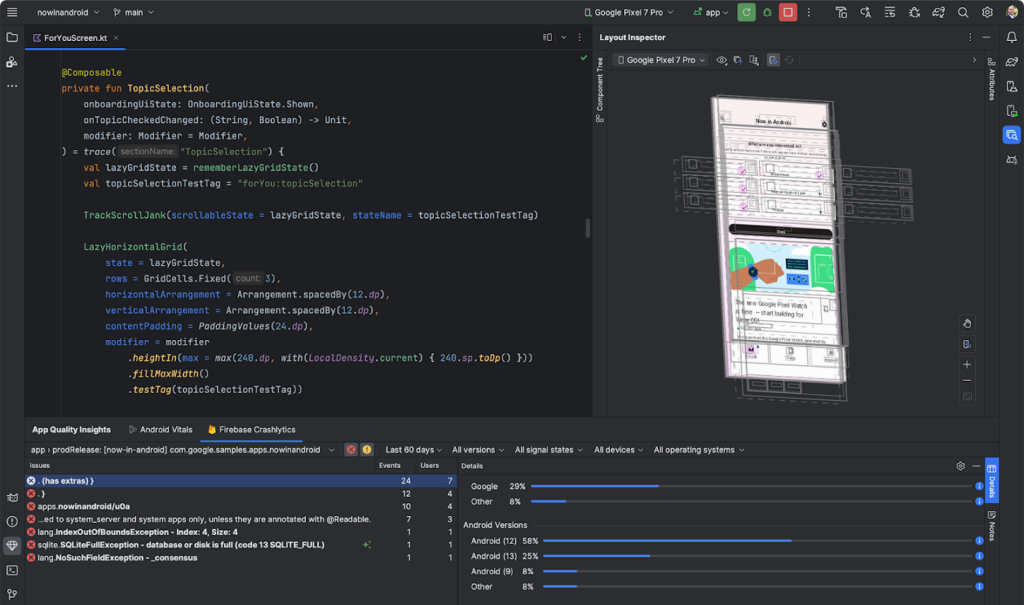

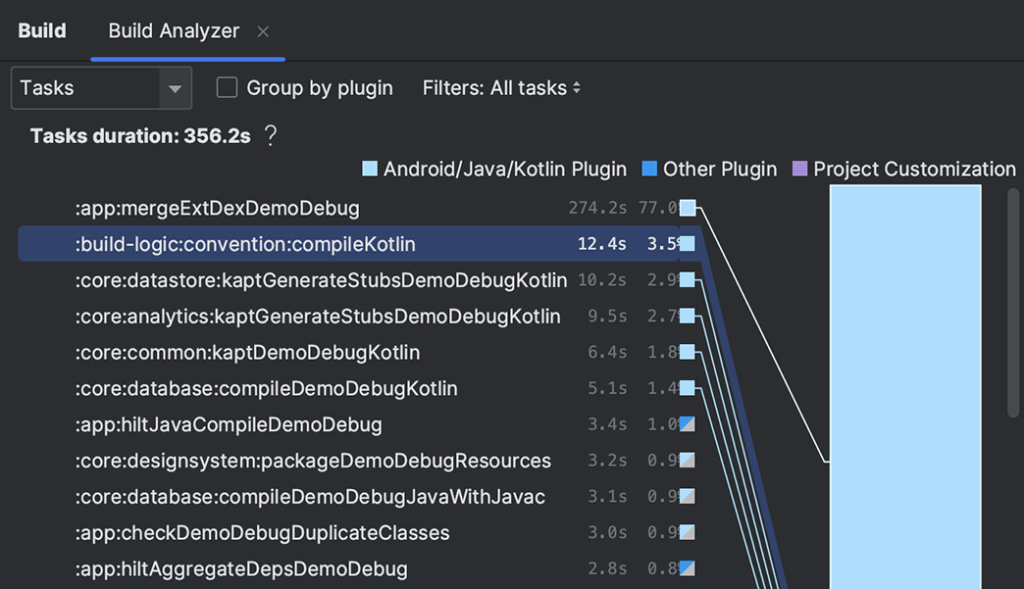

- Android Studio:

Android Studio is the official IDE for Android app development. It offers a rich set of features, including a visual layout editor, debugging tools, and performance profiling. If you’re building an Android app, using Android Studio is a must because it’s an all-in-one tool for developing, testing, and packaging Android apps.

Features you should not miss:

- Code editor: This amazing tool offers an intelligent code editor and code completion feature that will assist you in writing high-quality code faster. It supports languages like Kotlin, Java, C, and C++.

- APK analyzer: This feature allows you to see the composition of your app’s APK after you’ve built it, helping you reduce the size of your app and with debugging.

- Code templates: We know that a bit of help always comes in handy, and pre-made code templates for standard app features come in handy, speeding up development.

- Layout editor: This feature is specially made for designing user interfaces (UIs). With a drag-and-drop interface, the layout editor helps you rapidly build layouts and preview what they look like on different Android devices.

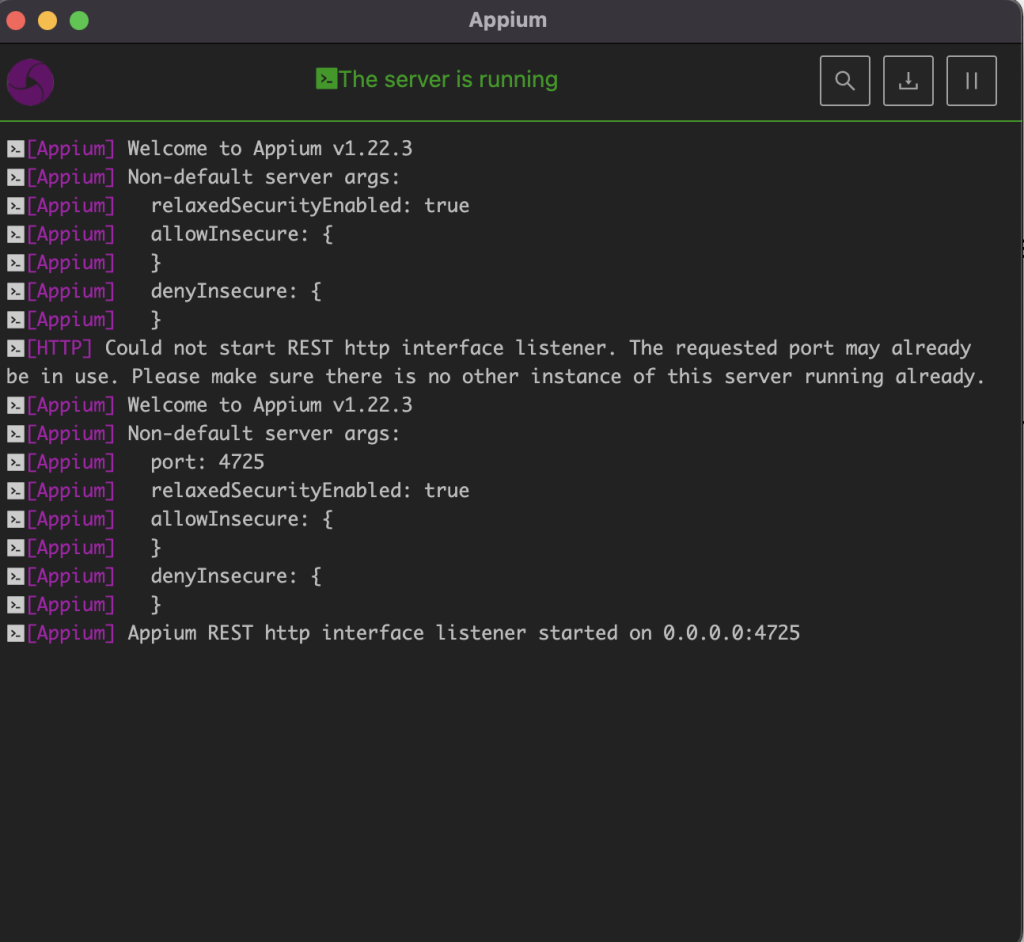

2. Appium:

It is an open-source project and ecosystem of related software designed to facilitate UI automation of many app platforms, including mobile (iOS, Android, Tizen), browser (Chrome, Firefox, Safari), desktop (macOS, Windows), TV (Roku, tvOS, Android TV, Samsung), and more. Its versatility and scalability make testing mobile apps much more efficient.

Features you should not miss:

– Cross-platform testing: As we saw before, this feature can save you a lot of time when testing your mobile app. You can test both Android and iOS apps with the same test script.

– Automated UI testing: Speaking of saving time, this feature will allow you to set up automated testing of your app’s UI so you can find and fix any issues early.

– No app modification needed: Appium works with real apps, so you don’t need to make additional modifications or SDKs to test your app.

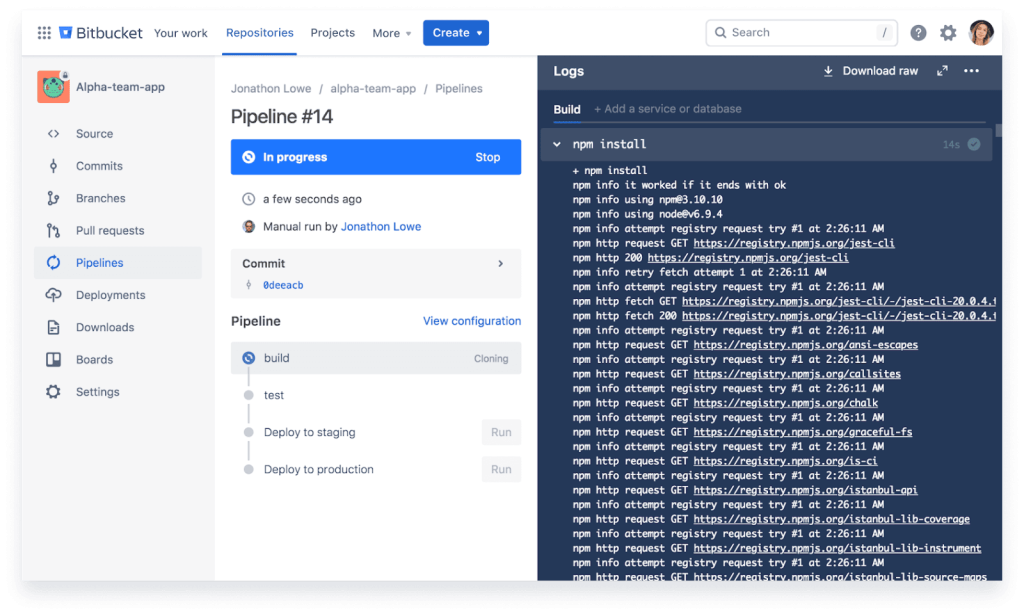

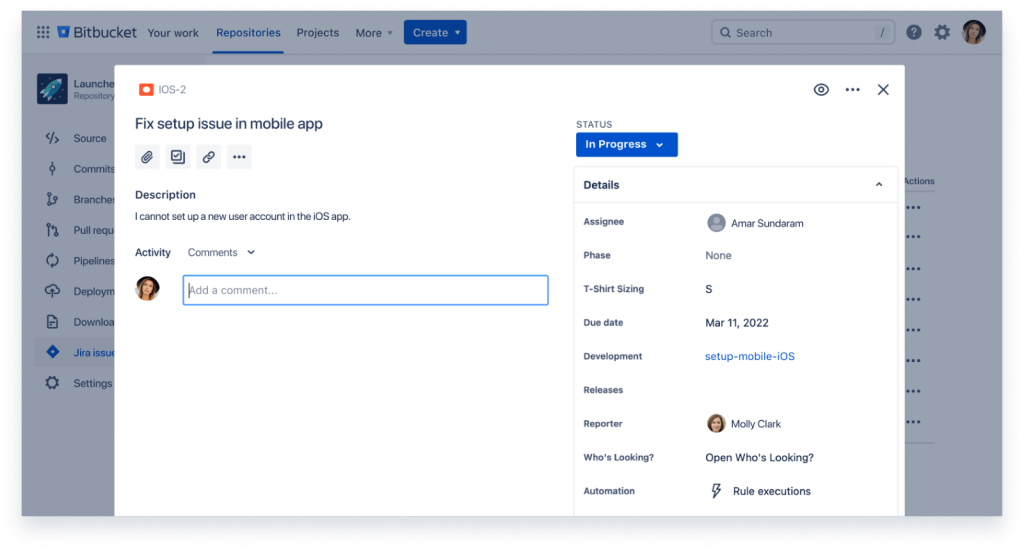

3)Bitbucket:

I It is a cloud-based version control service that stores and manages code specifically designed for business and enterprise use. With best-in-class Jira integration and built-in CI/CD, you can write, test, and ship code directly in Bitbucket. Also, it is the native Git tool in Atlassian’s Open DevOps solution, so you can easily integrate it with their other products, Jira, Confluence, and Trello.

Features you should not miss:

- Built-in CI/CD: As we saw before, this feature allows you to write, test, and deploy code directly in Bitbucket.

- Flexible deployment models: Made according to your needs, you can use Bitbucket as a cloud-based solution (Bitbucket Cloud) or for data centers (Bitbucket Data Center).

- Branch permissions: With this feature, you can improve the security of your code because you can manage who can commit and push code to specific branches in the repository.

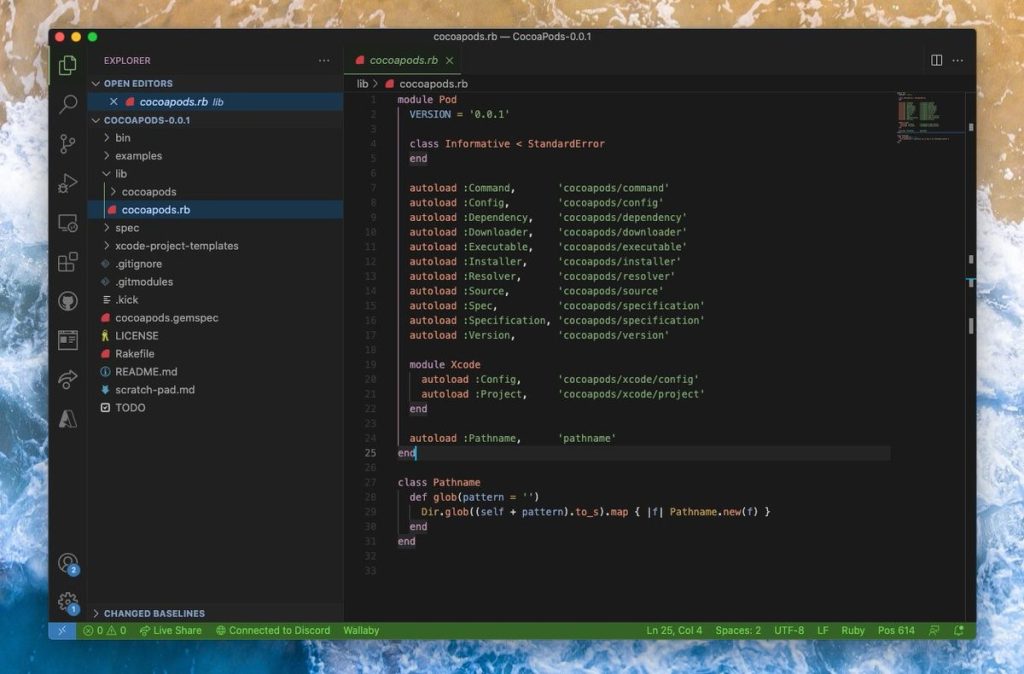

4) CocoaPods

It is a dependency manager for iOS and macOS projects, where you can add third-party libraries and frameworks to a project you’re working on in Xcode. It can help you scale your projects elegantly by simplifying managing dependencies and configuring external code so you can focus entirely on building your iOS app.

Features you should not miss:

- Dependency management: This is the main feature, and it will help you manage dependencies and libraries when developing your app.

- Centralized repository: As we saw before, this feature allows you to find and integrate the libraries you need for your project.

- Integration with Xcode: Allows you to easily add and update the libraries you need as you’re working on your app.

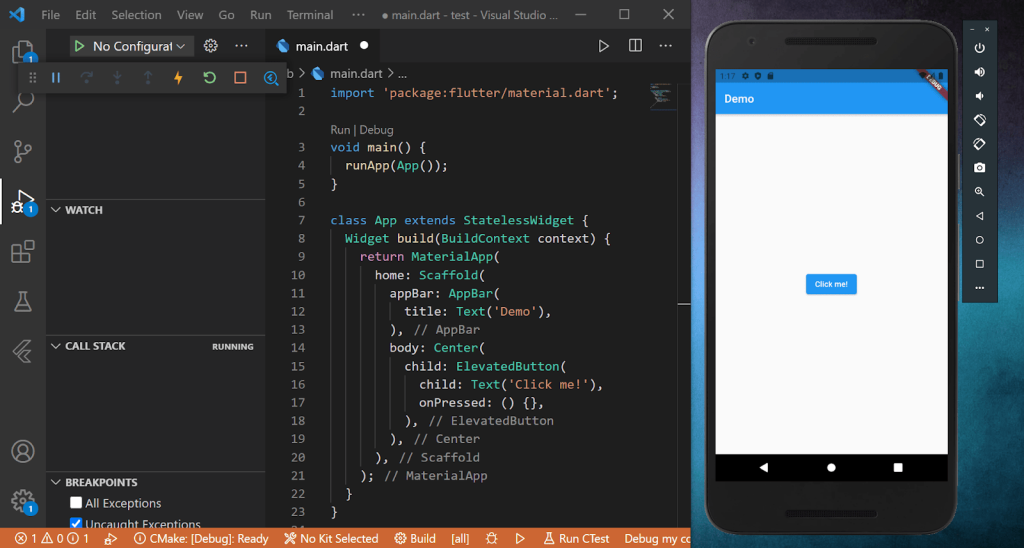

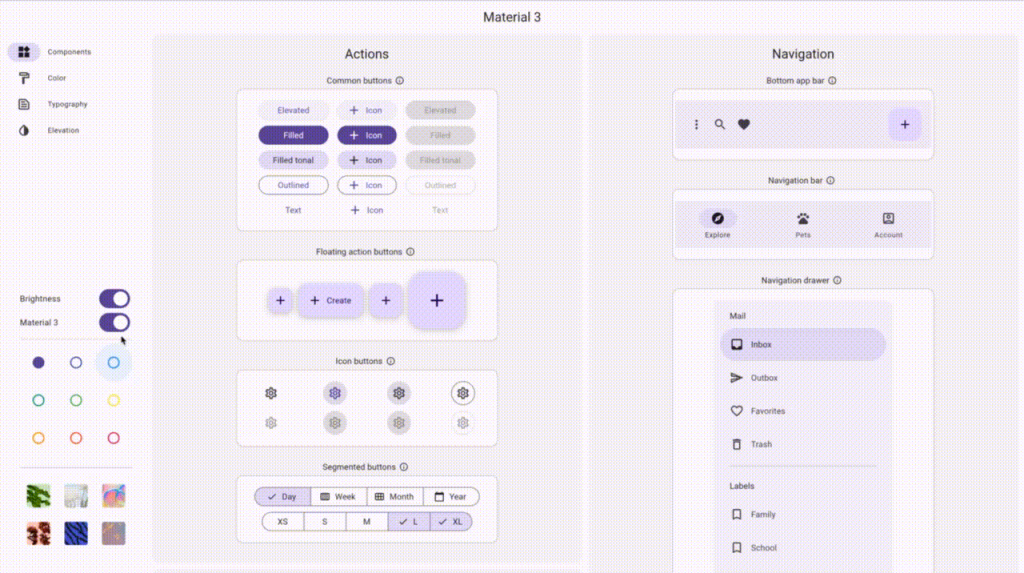

5) Flutter

It is an open-source front-end framework used to develop cross-platform apps using a single codebase. This means you don’t have to create separate native apps for each platform, which is very cost-effective and helps you reach a wider audience with your app. Also, it uses the Dart programming language and offers a rich set of pre-designed widgets.

Features you should not miss:

– Real-time reload: Save time with this feature; you will see the code changing in real-time, so you don’t need to restart your app.

– Customizable widgets: Create great-looking UIs for your app.

– Single codebase: Save time and money building apps for Android and iOS from a single codebase.

Conclusion

The future of banking will be marked by rapid innovation, driven by the proliferation of cloud platforms and APIs, and by exponential development in AI and cybersecurity. Therefore, understanding and knowing the trending tools in software development will help you cut short time-to-market, optimize resource utilization, develop a feature-rich solution, and increase ROI.

Make sure that the software development tools of your choice satisfy your business requirements and that your software projects team can work with them.

At ThinkUp, we are always interested in knowing your agenda and priorities.

Ready to leap?

Consider partnering with ThinkUp, an experienced fintech app development company that understands the intricacies of fintech mobile apps. Let us help you transform your business and stay competitive in today’s fast-paced.